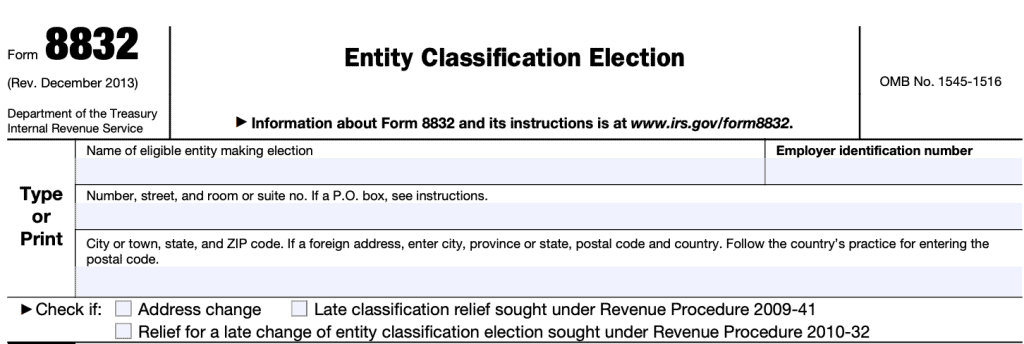

Understanding tax procedures can be tricky. There are many rules and numbers. Two important ones are Rev Proc 2009-41 and 2010-32.

What is Rev Proc 2009-41?

Rev Proc 2009-41 is about tax relief. It helps people who own homes. Sometimes, people lose homes. This can be because they cannot pay their loans.

This rule gives relief. It makes sure people do not pay more tax. This is important when a home is lost.

Why Is Rev Proc 2009-41 Important?

It helps during hard times. Losing a home is sad. This rule stops extra tax problems.

What is Rev Proc 2010-32?

Rev Proc 2010-32 is different. It is about foreign income. Sometimes, people earn money in other countries.

This rule helps with tax credits. It stops people from paying double tax. Double tax means paying twice on the same money.

Why Is Rev Proc 2010-32 Important?

It is good for people working abroad. They need fair tax rules. This helps them keep more money.

How Are Rev Proc 2009-41 and 2010-32 Different?

Both rules help with taxes. But, they help in different ways. Rev Proc 2009-41 helps with home loss. Rev Proc 2010-32 helps with foreign income.

| Rev Proc 2009-41 | Rev Proc 2010-32 |

|---|---|

| Focuses on home loss | Focuses on foreign income |

| Helps reduce tax after losing a home | Helps reduce double tax for foreign income |

| Important during financial trouble | Important for those working abroad |

Who Needs to Know About These?

People who own homes should know Rev Proc 2009-41. It helps if they face home loss.

People working abroad need Rev Proc 2010-32. It helps save money on taxes.

How Do These Procedures Work?

Both rules have steps. Rev Proc 2009-41 has steps for home loss. Rev Proc 2010-32 has steps for foreign income.

Steps For Rev Proc 2009-41

- Check if you qualify for relief.

- Understand what relief means for you.

- Follow the steps to apply for relief.

Steps For Rev Proc 2010-32

- Check foreign income rules.

- See if you qualify for tax credits.

- Apply for credits to reduce tax.

Why Are These Procedures Created?

They help people in need. They make sure people are not taxed unfairly. They offer support during tough times.

Rev Proc 2009-41

Created for home owners. Especially those who lose their homes. It aims to ease financial burdens.

Rev Proc 2010-32

Made for people earning abroad. It ensures they do not pay tax twice. This is fair and necessary.

Frequently Asked Questions

What Does Rev Proc 2009-41 Cover?

Rev Proc 2009-41 deals with the tax treatment of certain investments in partnerships. Clear guidelines for tax implications.

What Is The Focus Of Rev Proc 2010-32?

Rev Proc 2010-32 provides guidance on claiming tax credits for certain investments. It ensures compliance with tax laws.

Are Rev Proc 2009-41 And 2010-32 Related?

Both relate to tax procedures but focus on different aspects. One on partnerships, the other on tax credits.

How Do These Procedures Impact Tax Filings?

They guide taxpayers on correct filing methods. Ensuring compliance with IRS requirements for specific situations.

Conclusion

Tax rules can be confusing. But they are there to help. Rev Proc 2009-41 and 2010-32 are important.

Remember, Rev Proc 2009-41 helps with home loss. Rev Proc 2010-32 helps with foreign income.

Understanding these can save money. And reduce stress. Learn them well. They are there for support.